TM&I LNG Flexibility Factor Report

TRELLEBORG MARINE AND INFRASTRUCTURE The Flexibility Factor: Energy Transfer Insights AN OVERVIEW OF LNG TODAY FOR MEETING CHANGING INFRASTRUCTURE REQUIREMENTS

Contents Introduction 3 LNG Trends & Analysis of Infrastructure Development 4 Importance of Flexibility 11 Trelleborg’s Expertise 13 Summary 14 DISCLAIMER While the information and the opinion of our experts in this report is considered to be true and correct at the date of publication, changes in circumstances and market conditions after the time of publication may impact the accuracy of the information. The information may change without notice and Trelleborg is not in any way liable for the accuracy of any information printed and stored or in any way interpreted and used by a user.

Introduction THE ROLE OF LNG ON THE JOURNEY TO NET ZERO The growing global climate crisis is driving the The need to meet sustainability goals in more mature search for cleaner energy sources. Changes global markets is accelerating infrastructure changes. in market dynamics are spurring the evolution As LNG applications evolve, facilities must adapt and growth of specific sub segments such as innovative infrastructure and vessels to ensure they liquefied natural gas (LNG) as an alternative continue to operate safely, efficiently, cost-effectively, fuel source. and timely. As the move towards a carbon-neutral economy gains LNG fueling is becoming an alternative choice for momentum, the demand for LNG and its related shipping lines wishing to reduce their carbon footprint infrastructure will only increase. with immediate impact. Today, there is around 20% less CO and virtually zero NOx and SOx – this has 2 Spot Contracts Demand contributed to the development of new markets within Operational Flexibility the LNG industry, initiating unprecedented levels of ship and bunker vessel building and new gas Driven by growth, the LNG industry has entered a mature- train construction. market phase. The LNG trade no longer revolves around long-term contracts that guarantee predictability. The Growing Demand for market has instead expanded to include spot contracts LNG Infrastructure and short-term contracts that are more flexible, requiring greater adaptability, as well as safety and efficiency. Developing economies are creating new markets and applications and driving demand for reliable and The ability to adapt to spot contracts and also their durable LNG infrastructure. This consists primarily of operations in a safe and effective way across multiple tankers, import and export terminals, floating storage jurisdictions is crucial for operators in both small- and facilities, bunker vessels, and inland storage plants. large-scale LNG operations.

LNG Trends & Analysis of Infrastructure Development THE EVOLUTION OF LNG APPLICATIONS Operators are improving infrastructure by upgrading jetties to support bigger vessel types, using floating units as semi-permanent storage structures with on board liquid to gas conversion (FSRU), or using ship-to-ship transfers more regularly to meet demand. However, if paired with existing infrastructure that is no longer fit for purpose, all of these potential solutions will impact efficiency and – importantly – safety. Globally, a growing number of ports and terminals are gradually upgrading their facilities to offer LNG bunkering services to prevent potential operational disruptions. These shore-based facilities are often strategically located in regions with stricter emissions control regulations and near LNG import terminals for efficient distribution. However, due to its low capital investment and the limited infrastructure required, truck-to-ship is currently the most widely used configuration at terminals and ports today for LNG. The truck-to-ship configuration does, however, have flow rate limits and volume restrictions, limiting it to short sea-trade support. For international trading vessels, marine bunkering at sea will be required. Alternative methods, such as ship-to-ship and shore-to- ship transfers, support larger storage capacity and higher bunkering rates. However, both involve substantial capital outlay in bunker vessels and fixed infrastructure, including storage tanks and specialized loading systems. An alternative transfer method is to use hoses over loading arms. Hoses allow for a quick transfer of fuel to multiple LNG-powered vessels. Hoses are also versatile as they can accommodate various manifold locations.

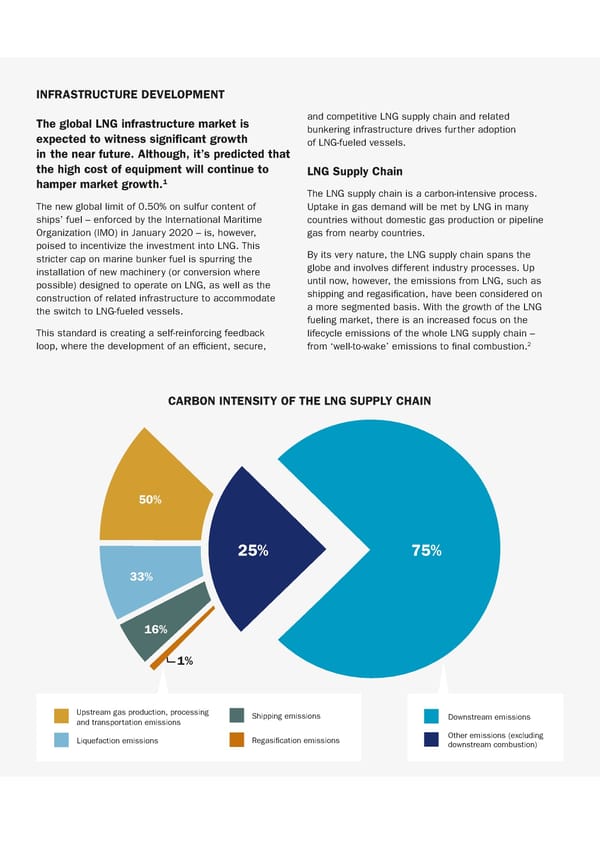

INFRASTRUCTURE DEVELOPMENT The global LNG infrastructure market is and competitive LNG supply chain and related expected to witness significant growth bunkering infrastructure drives further adoption of LNG-fueled vessels. in the near future. Although, it’s predicted that the high cost of equipment will continue to LNG Supply Chain hamper market growth.1 The LNG supply chain is a carbon-intensive process. The new global limit of 0.50% on sulfur content of Uptake in gas demand will be met by LNG in many ships’ fuel – enforced by the International Maritime countries without domestic gas production or pipeline Organization (IMO) in January 2020 – is, however, gas from nearby countries. poised to incentivize the investment into LNG. This By its very nature, the LNG supply chain spans the stricter cap on marine bunker fuel is spurring the globe and involves different industry processes. Up installation of new machinery (or conversion where until now, however, the emissions from LNG, such as possible) designed to operate on LNG, as well as the shipping and regasification, have been considered on construction of related infrastructure to accommodate a more segmented basis. With the growth of the LNG the switch to LNG-fueled vessels. fueling market, there is an increased focus on the This standard is creating a self-reinforcing feedback lifecycle emissions of the whole LNG supply chain – loop, where the development of an efficient, secure, 2 from ‘well-to-wake’ emissions to final combustion. CARBON INTENSITY OF THE LNG SUPPLY CHAIN 50% 25% 75% 33% 16% 1% Upstream gas production, processing Shipping emissions Downstream emissions and transportation emissions Liquefaction emissions Regasification emissions Other emissions (excluding downstream combustion)

PROJECTS ATTRACTING INVESTMENT FLNG and FSRU Technology LNG is a global commodity with 21 countries Historically, much of the world’s gas reserves have 3 been commercially inaccessible. Floating liquefied natural exporting to 42 importers. The bunkering gas (FLNG) technology is helping to open up connections, infrastructure to support LNG as a marine driving the emergence of new geographic markets. fuel continues to snowball. At the same time, recent and emerging LNG markets LNG Bunkering are driving the demand for offshore and terminal floating storage and regasification unit (FSRU) development. To meet growing demands, LNG infrastructure has shown FSRU technology enables the import of LNG to countries clear signs of growth, with 124 ports now providing LNG without the infrastructure. As operators capitalize on 4 FSRU development, the FSRU market size is estimated bunkering facilities. In early 2019, there were just six LNG bunkering vessels in operation: five in Europe and to grow by a CAGR of 8%, with 81.92 MT between 2021 8 one in North America. As of July 2020, this has more and 2025. than doubled, growing to 13 in service, with a further 28 on order and/or undergoing commissioning.5 Europe currently boasts the majority of LNG bunkering ports, although similar facilities are starting to flourish in 6 Southeast Asia and the United States. SGMF data suggests that over 318 LNG-fueled ships are operating across the globe with 532 more on order.7 The data also suggests that 31 LNG bunker ships are operating globally – with 24 more on order – while 98 ports are offering LNG as a fuel. LNG Exports Political instabilities in Europe in 2022 have resulted in bunkering activity being driven away from Russia as shipowners avoid Russian-origin cargoes. These instabilities have resulted in high LNG prices in 2022, which will, however, boost investments in LNG export capacity in the medium to long term.

LNG CHALLENGES AND OPPORTUNITIES Opportunity #1: Economic Growth Opportunity #3: Investment in Global Economic challenges remain, including emerging LNG Infrastructure is Recovering market currency concerns, but growth has proven Global LNG demand is expected to grow by 53% resilient in key markets like China, providing cyclical 12 to 560 million tonnes per annum (MTPA) by 2030. 9 headwinds for the LNG industry. In response to the rising demand, Qatar Petroleum Increasing adoption of LNG fueling infrastructure by large Company recently announced that it would expand its ports presents a clear opportunity for LNG distribution North Field LNG facility by 32 million tonnes per annum. to become more widespread around the globe. Moreover, Gazprom is in the process of building the 13 Opportunity #2: New Types of End Users million tonnes per annum Baltic LNG facility in Russia. Some applications, like LNG fueling, have developed In addition, Australia’s Santos Ltd has approved its significantly over the last few years, but the longer-term Barossa gas project off northern Australia to backfill the 3.7 MTPA Darwin LNG plant.13 upsides remain to be seen. There is increased use of LNG in trucking, especially in China, while floating Opportunity #4: Technology as a Catalyst import terminals offer flexibility and access to smaller markets such as Egypt, Jordan, Pakistan, and potentially In a rapidly evolving LNG market, the use of new 10 Australia. At the same time, LNG-powered rail could technologies can facilitate greater flexibility, transparency, lower fuel costs, although the Energy Information and efficiency between buyers and sellers, thus bridging Administration expects the uptake to be relatively slow.11 the gap between them. These new types of end users provide a faster route The challenges of implementing new technologies in the to market than building shore-based gas facilities existing infrastructure can be significant. However, its for power stations. benefits outweigh the disadvantages.

Challenge #1: Political Instabilities Challenge #3: Contract Issues Political instabilities have caused an increase in Differences in value chain can derail a project. For natural gas prices, casting longer-term uncertainty on example, different cost recovery systems complicate the the prospects of natural gas, particularly in developing allocation of costs to infrastructure, the LNG liquefaction markets where the gas was set to play a fundamental or regasification plant, and any separate pipeline project. role in energy transitions. This uncertainty means that The extent to which downstream infrastructure costs can natural gas demand is expected to remain subdued up be recovered through upstream production is often an 14 to 2025. issue, alongside differing timelines for licensing, To relieve price competition, quicker development of clean relinquishment and investment. energy transition policies is key, and would help emerging Investing in new downstream infrastructure, however, markets access supplies that can generate positive is needed to realize growth potential. Today, with changes in air quality and carbon intensity. midstream energy infrastructure projects virtually drying out, infrastructure investors are venturing downstream in Challenge #2: Alternative Fuels search of assets structured to fit their investment profile. LNG has the advantage of generating lower carbon Between 2008 and 2017, spot and 15 emissions than other conventional fuels. However, short-term LNG offtake contracts it can never be carbon-free. A significant amount of grew from 20% to 30% of volumes progress has been made in the field of sustainable exported. 76% of respondents believe alternative fuels. There are currently several alternatives in development and production, including ammonia that these contracts will grow faster and hydrogen, which have proved technically feasible, than overall LNG trade.18 16 although not yet commercially available. Using hydrogen as a fuel directly requires either Challenge #4: Climate Change compression, for limited range applications, or Increasing sea levels and worsening weather liquefaction to store larger volumes for typical trade patterns pose a threat to LNG infrastructure today. patterns. It is also a challenge to contain large volumes It puts an increased strain on ports, facilities, and of the smallest and most flammable atom at -260°C vessels, as well as posing a risk for catastrophic without leakage. damage to infrastructure. It may be preferable to use ammonia since containment is simpler. There are, however, severe life risks associated with it because of its high toxicity. As well as tank and pipeline containment, the combustion cycles of engines or inefficient SCR (Selective Catalytic Reduction) may release ammonia via ‘ammonia slip’ which needs addressing before any large-scale rollout can be undertaken. Despite these challenges there are 17 many serious trials underway. With all alternative fuels, including LNG, the energy density needs to be addressed, to carry the equivalent fuel volumes compared to HFO or diesel. Consequently, larger fuel tanks are required. The result is either a reduction of range or a reduction of cargo carrying capacity, since larger fuel tanks limit cargo space.

NATURAL GAS GROWTH ACROSS Central, South and East Asia DIFFERENT REGIONS In the first five months of 2021, Asian LNG demand 21 Global LNG trade grew by 4.5% from 2020 firmly returned to growth, with China and India to 2021, reaching an all-time high of 372.3 leading the recovery in demand for LNG by increasing 22 MT. A strong post-pandemic recovery their LNG imports by 11% each. China’s target 23 resulted in a surge in LNG imports, even to become carbon neutral by 2060 is expected though the annual growth rate of 4.5% to perpetuate its LNG demand through the key role remains far from pre-COVID-19 levels of gas can play in decarbonizing hard-to-abate sectors. 19 Japan, meanwhile, has suffered a deterioration in their 13.0% in 2019. 24 economic outlook as a result of COVID-19. Global natural gas consumption is expected China witnessed blistering growth in the first to contract and grow slowly over the half of 2021 after 28% year-on-year growth in following years as political instabilities the first six months of the year.25 continue to push prices up, fueling fears of 20 supply disruptions. Saudi Arabia Natural gas plays a critical role in Saudi Arabia’s long- term growth and diversification, but the lack of import infrastructure keeps demand dependent 26 on supply. Sub-Saharan Africa Although the project pipeline in Sub-Saharan Africa has been steadily developing, the focus of LNG in the region today is most likely to be on refining existing projects rather than initiating new ones. An electricity plan has been approved by the Cabinet to relieve current 27 electricity supply constraints in South Africa. However, there is currently no LNG import infrastructure in place. Increasing electric power generation and the development of natural gas infrastructure provide key countries in the region with an attractive opportunity for 28 LNG regasification investment, giving operators the flexibility to meet short-term contract requirements in the Sub-Saharan Africa region.

Europe and Western Europe LNG demand from Europe is being met by diverting cargoes bound for other destinations. This is due to the political instabilities in 2022, which have caused a supply crunch that will last for years. As Europe aims to reduce its dependence on Russian natural gas, it’s estimated that Europe’s consumption of LNG will double in 2022. Even if producers could increase production immediately, Europe does not have the infrastructure to absorb the LNG necessary to completely avoid using Russian gas before 2024. However, if the US and Qatar build additional capacity as planned, the transition 29 from Russian LNG exports will be achievable in the longer term. Latin America The economic recession across the region throughout 2020 affected 30 natural gas infrastructure investments over the short to medium term. The period 2019-2020 saw South America’s imports fall by around 15% owing to growing domestic gas production and weak economic 31 conditions. The situation changed in 2021 when a severe drought in Brazil resulted in a substantial reduction in available hydropower capacity – responsible for roughly 70% of Brazil’s power needs – causing LNG imports to rise 60%.32 While South American demand is a small proportion of the global LNG demand, any increase in demand pulls marginal Atlantic cargoes away from the European sink (and its empty storages), contributing to the surge in European energy prices.33

Importance of Flexibility Flexible LNG Solutions Docking Flexibility Across international markets, LNG is traded It is important for vessels and ports to be designed as a commodity. In international shipping, it is used as for compatibility with multiple types of docking to enable a fuel. Each market requires flexible solutions to ensure the safe transfer of fuel during ship-to-ship, ship-to-shore, safety, efficiency, cost effectiveness, and, ultimately, the or single-point mooring operations. With vessels having success of the business model – from ship-shore links multiple docking options to onboard/offboard fuel and for FSRUs to hybrid-GEN3 solutions for bunker vessels. ports having to accommodate these options, smart New projects need to find fast return on investment navigation and piloting solutions can help make docking (ROI), while established facilities must keep pace operations and transfer of fuel safer. with today’s changing demands. Improving Interface Management Volume Flexibility LNG’s global scope and varied applications make diversity Volume flexibility is one solution that gives purchasers the norm. From traditional terminals to bunker barges the ability to reduce the annual contract volume and, and everything in between, project requirements vary as a result, their take-or-pay obligation. A surplus of LNG substantially, inviting varied solutions and complicating supply on the market is prompting purchasers to opt for interface management at transfer touchpoints. short-term rather than long-term contracts. Optimizing the interface at all stages of the LNG supply chain is integral to supporting every transfer operation, and can only be assured through the adoption of consistent communication and standardized processes.

Efficient Equipment Delivers Flexibility Adopting easily configurable and compatible equipment systems delivers several benefits such as an enhanced overview of operations, improved productivity, reliability, safety, and, ultimately, faster ROI to all stakeholders. Efficient systems that offer these benefits are able to provide support to LNG operators that require operational flexibility to adapt to spot contracts. Conversely, fragmentation creates inefficiencies and safety issues, and reduces the opportunity to implement flexible business models. A standardized approach across facilities opens up opportunities for all stakeholders through common requirements and systems. Standardization of systems improves operational control. At the same time, data sharing between parties is enhanced, enabling effective communications, fast response to potential issues, and empowered long-term decision making. This level of compatibility necessitates robust system architecture design from the outset, as well as cooperation between stakeholders and an understanding of cross-party requirements. The Role of Specification Every port and terminal is unique. Identification of the correct specifications and a comprehensive understanding of materials and applications early on in a project are crucial to ensure its long-term performance and safety. At the same time, products must meet differing regulatory requirements globally, and suppliers must understand and integrate all necessary standards into their solution – and be prepared to provide first-class 24/7 support when it’s needed to ensure downtime is kept at a minimum. An experienced, knowledgeable and technical supplier is essential to ensure that all specifications and services are met anywhere across the globe.

Trelleborg’s Expertise For over 50 years, Trelleborg has been central More recently, Trelleborg has taken this knowledge to the LNG industry, shaping and taking action and expertise into the emerging LNG bunkering market as it’s evolved. With a reputation for thought with development of our GEN3 SSL/USL hybrid ship-shore leadership, innovation, product design, and link systems, which allow bunker vessels to replenish providing effective business solutions, we work their tanks from a large-scale LNG terminal and then service a global fleet of smaller, LNG-fueled vessels. with industry bodies to set industry standards. We understand that it is critical that our Trelleborg will help you understand the opportunities for systems are designed to work effectively LNG infrastructure at your port or terminal and will create in different locations around the globe bespoke solutions to meet your operational needs in LNG. Our solutions include navigation and piloting technologies and in different jurisdictions. that will help you navigate to within 1 cm of accuracy, as The LNG industry demands integrated solutions rather well as advanced docking and mooring equipment and than individual products, so our primary focus is bespoke fender systems, which are all designed engineering LNG solutions that offer configurability, to increase the safety, efficiency, and sustainability compatibility, and flexibility for your bespoke operational of your operations. requirements. Our comprehensive knowledge of the In addition, Trelleborg also offers after- safety and technical requirements of different countries allows us to offer state-of-the-art solutions that meet sales services. These services include the highest safety and quality standards. In addition to comprehensive training and maintenance our global technology network, we also have a worldwide programs, which enable management teams aftersales team available to provide support 24/7. to provide first-line support to staff, while Trelleborg has been leading the way in integrated our 24/7 maintenance and repair programs ship-shore link technology development and the offer regular preventative maintenance of design for liquefied natural gas carriers (LNGCs), your bespoke equipment in order to reduce shore terminals, FSRUs and floating LNG downtime and prevent costly repairs. applications such as Shell Prelude.

Summary IN CONCLUSION REFERENCES Demand for cleaner fuels is set to propel LNG fueling 1 Allied Market Research, Liquefied Natural Gas (LNG) Infrastructure Market by Type (Liquefication Terminal, and Regasification into a mature market phase – where spot contracts are Terminal), and End-User Industry (Heavy-Duty Vehicles, Electric Power Generation, and Marine Transport) – Global Opportunity utilized, rather than solely long-term contracts. In addition Analysis and Industry Forecast, 2021 to developing economies driving new markets, the 2 https://www.herbertsmithfreehills.com/latest-thinking/ decarbonisation-of-the-lng-supply-chain-challenges-and-the- global LNG infrastructure market is expected to witness wayforward 3 SEA LNG, LNG – The Only Viable Fuel, 2020 significant growth in the near future. 4 SEA LNG, 2021 Outlook for LNG – a View From the Bridge, 2021 5 SEA LNG, LNG – The Only Viable Fuel, 2020 However, LNG infrastructure must be able to keep up with 6 https://www.ship-technology.com/features/lng-bunkering- facilitiesaround-the-world/#:~:text=While%20Europe%20boasts%20 demand. Accelerating LNG fueling to meet sustainability the%20majority,Asia%20and%20in%20the%20US demands requires LNG infrastructure that can cope with 7 https://www.sgmf.info/: Accessed August, 2022 demand by berthing more and more LNG-powered vessels 8 Global Floating Storage Regasification Unit (FSRU) Market 2021- 2025 safely and efficiently. 9 Deloitte, Remodel, reinvent: How technology and changing business models are impacting the future of LNG, 2019 10 Deloitte, Remodel, reinvent: How technology and changing In order to respond to LNG’s various challenges and business models are impacting the future of LNG, 2019 opportunities, LNG leaders must adapt to the needs 11 Energy Information Administration, Liquefied natural gas shows potential as a freight locomotive fuel, April 14, https://www. of spot contracts, changing environments, and transfer eia. gov/todayinenergy/detail.cfm?id=15831, 2014: Accessed February 1, 2016. scenarios. To do this and help ensure your LNG 12 https://www.reuters.com/article/global-lng-investments- operations take place safely and efficiently, idUSL4N2P32XV 13 https://www.reuters.com/article/global-lng-investments- operational flexibility is crucial. idUSL4N2P32XV 14 https://www.iea.org/reports/gas-market-report-q3-2022 15 https://www.fortisbc.com/est/marine/environmental-benefits-of- Discover Global Solutions Showcase lng-fuelled-marine-vessel 16 https://www.lr.org/en-gb/insights/articles/decarbonising-shipping- Trelleborg’s innovative and pioneering solutions have ammonia/ 17 https://www.nyk.com/ English/news/2021/20210422_01.html been meeting the demand for LNG from the outset. 18 International Gas Union, LNG World Report, 2018 Read how our LNG solutions are increasing the safety, 19 https://www.igu.org/resources/world-lng-report-2022/ sustainability, and overall efficiency of LNG operations 20 https://www.iea.org/reports/gas-market-report-q3-2022 21 https://www.lngindustry.com/special-reports/22062021/wood- across the globe today. mackenzie-china-to-overtake-japan-as-worlds-largest-lng-market/ 22 https://www.shell.com/energy-and-innovation/ natural-gas/liquefied-natural-gas-lng/lng-outlook-2020. html#iframe=L3dlYmFwcHMvTE5HX291dGxvb2sv 23 https://www.climateaction.org/news/china-pledges- EXPLORE CASE STUDIES carbonneutrality-by-2060 24 Fitch Solutions, LNG: Global Industry Trends, 2020 25 https://www.reuters.com/business/energy/chinas-lng-import- surge-cool-winter-high-prices-bite-2021-08-25/ 26 Fitch Solutions, LNG: Global Industry Trends, 2020 27 https://www.nortonrosefulbright.com/en-za/knowledge/ publications/89977412/global-lng-outlook-2021 28 Fitch Solutions, LNG: Global Industry Trends, 2020 29 http://country.eiu.com/article. aspx?articleid=392130222&Country=Russia&topic=Economy& subtropic=Forecast&subsubtopic=Commodity+prices 30 Fitch Solutions, LNG: Global Industry Trends, 2020 31 https://timera-energy.com/south-american-lng-imports-rebound- in-2021/ 32 https://timera-energy.com/south-american-lng-imports- reboundin-2021/ 33 https://timera-energy.com/south-american-lng-imports- reboundin-2021/

Trelleborg is a world leader in engineered polymer solutions that seal, damp, and protect critical applications in demanding environments. Its innovative solutions accelerate performance for customers in a sustainable way. WWW.TRELLEBORG.COM/MARINEANDINFRASTRUCTURE Facebook: TrelleborgMarineandInfrastructure Twitter: @TrelleborgMI Youtube: Youtube.com/c/trelleborgmarineinfrastructure Flickr: flickr.com/people/marineandinfrastructure Linkedin: Linkedin.com/company/trelleborg-marine-and-infrastructure Blog: Thesmarterapproachblog.trelleborg.com Scan the QR code here to download our case study brochure Trelleborg Marine and Infrastructure continues to be central to the LNG industry. Explore our efficient, sustainable and safe LNG transfer solutions that are in operation across the globe Trelleborg Marine and Infrastructure Email: marine_infra@trelleborg.com #30082022